Tokenization: towards a new digital economy

The almost exponential development of e-commerce and the generalization of the payment card are causing profound changes in electronic banking. This is how S2M implemented one of these developments aimed at guaranteeing the security of banking transactions while allowing a better understanding of customer habits: TOKENIZATION.

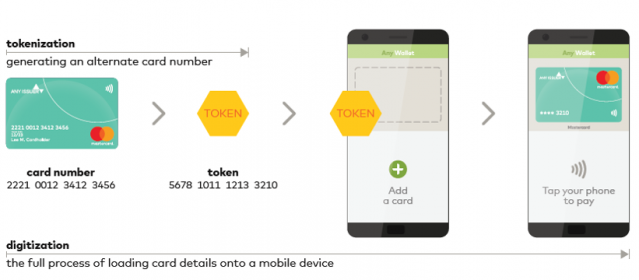

When a customer initiates a payment on his mobile, sensitive data is transmitted to the Token Service Provider (TSP) entity, which then replaces the bank card number with a series of numbers, called “token”, randomly generated by an algorithm. This action allows payment to be made via the Internet without exposing the bank details.

Aware of the importance of this subject and having a key role in data protection, S2M provides communication interfaces with the TSPs managing the sending party. It also guarantees the control of tokenization requests and activates them following customer identification. Finally, S2M manages the life cycle of tokens, the costs, and risks associated with digitization, fraud attempts or even specific controls.

These functionalities are already in production with S2M customers in New Zealand and Australia and are being implemented with 6 large customers in Jordan.