Problem

Developments and market dynamics fuel the transformation of the financial sector and multiply the challenges. CFG Bank faced the exponential demands of the service market and competition initiatives and had to be competitive in new technology.

Solution

In order to optimize the experience of their customers on site, to make it more transparent and personalized, to promote customer engagement, and above all to remain true to its promise of innovation, CFG Bank is the first bank in Morocco to have launched the Instant issuance of cards in its branches by opting for S2M’s Solution: « SEDIC ».

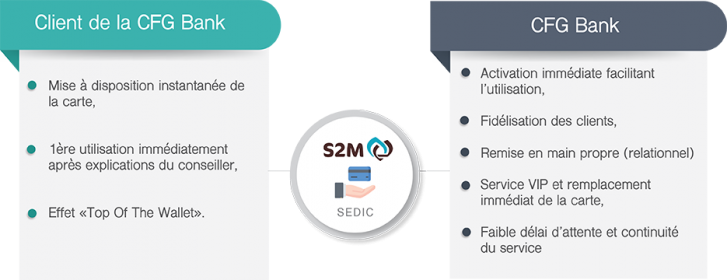

By opting for this new service and equipping all its new generation agencies with the SEDIC solution, CFG Bank as an issuer and its customers as users benefit from the following advantages:

Today, at CFG Bank, it is no longer necessary to wait to recover your means of payment. At the opening of your account, you receive on the spot and in less than 15 min your bank card and your pin code.

Client: